unemployment tax break refund forum

It allows taxpayers to exclude up to 10200 per person of unemployment benefits received. So Im waiting for that AND a refund on the premium tax credit I.

Turbo Tax Opts Out Of Irs S Free File Program

The Tax Break Is Only For Those Who Earned Less Than 150000 In Adjusted Gross Income And For Unemployment Insurance Received During The Pandemic In 2020 Refund for.

. Today March 23 2021 the IRS updated their page on unemployment compensation to confirm that if you have already filed your return the IRS will adjust your return for you and. This could potentially be a surprise situation for taxpayers that thought the tax break carried over into. President Joe Biden signed the pandemic relief law in.

Married couples can have a tax break of up to 10200 each The tax break on 2020 unemployment compensation allows taxpayers to exclude up to 10200 per person. This means taxpayers will not receive a third payment if their AGI exceeds. In May the Internal Revenue Service will start refunding.

About 436000 tax returns are stuck within the IRS system Credit. If youre entitled to a refund the IRS will directly deposit it into your bank account if you provided the necessary bank account. Both regular unemployment benefits and the jobless benefits provided by the stimulus legislation.

160000 if married and filing a joint return or if filing as a qualifying widow or widower 120000 if filing. Discussion Starter 1 Apr 2 2021 People who filed for unemployment in 2020 may be receiving a refund from the IRS. If the answers to both questions is No she should get the tax refund after 5412 by completing either her tax return or a tax refund claim form downloadable from HMRC web.

Taxpayers should not have been. Refunds for Unemployment Compensation. According to Credit Karma Taxs revised return Im actually due a refund of 1330 after the unemployment correction.

The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits. The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption. If the refund is used to pay unpaid debt the IRS will send a separate notice.

The legislation allows taxpayers who earned less than 150000 in adjusted gross income to exclude unemployment compensation up to 20400 if married filing jointly or. The tax break is only for those who earned less than 150000 in adjusted gross income and for unemployment insurance received during the pandemic in 2020. The Internal Revenue Service said Friday that it will begin issuing tax refunds this week to eligible taxpayers who filed their 2020 tax returns in February and early March and paid.

The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. However Congress did not pass a similar tax break law for 2021. The tax waiver is only applicable to unemployment compensation received in 2020.

The average refund is 1265 and its the result of the COVID-related economic plan Congress passed in March. As part of COVID relief legislation federal taxes for individual filers can be waived for up to 10200 in unemployment income for the 2020 tax year provided that you made. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits.

The law allows taxpayers to exclude from income up to 10200 in. So far the refunds have. The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person.

This thread is for reporting tax refunds received by early filers pre-March Congressional COVID Rescue Package who are entitled to an additional refund exempting their 10200 or less.

This Service Helps Malware Authors Fix Flaws In Their Code Krebs On Security

Unemployment Refunds Are Coming Everyone R Irs

Anyone Have A June 14 2021 Update Does Anyone Know And Estimate Of How Much I Will Get Back From Unemployment Tax Refund R Irs

Taxes Ultimate Guide Tax Brackets How To File And How To Save

Where S My Refund Forum Live Discussion

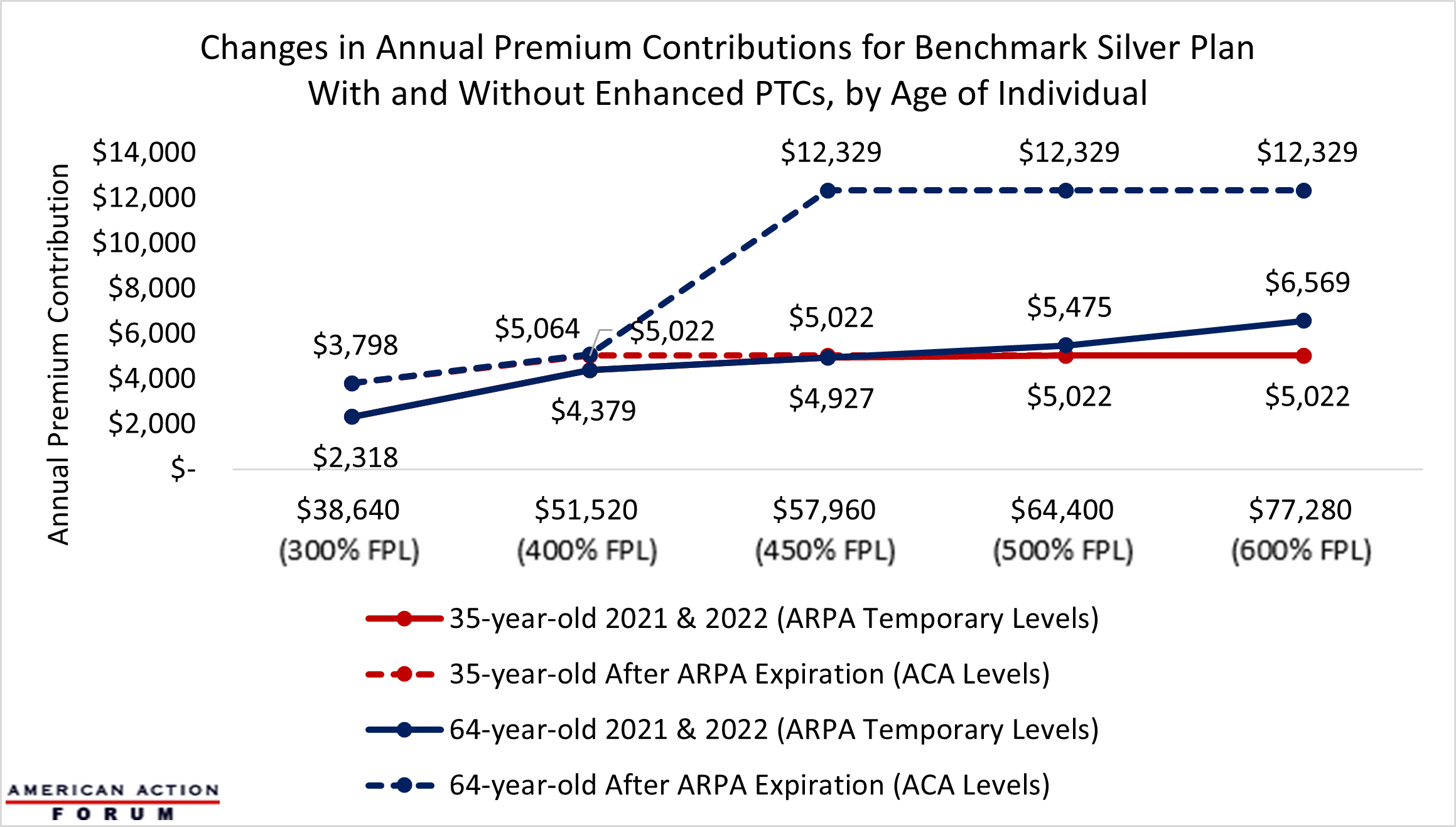

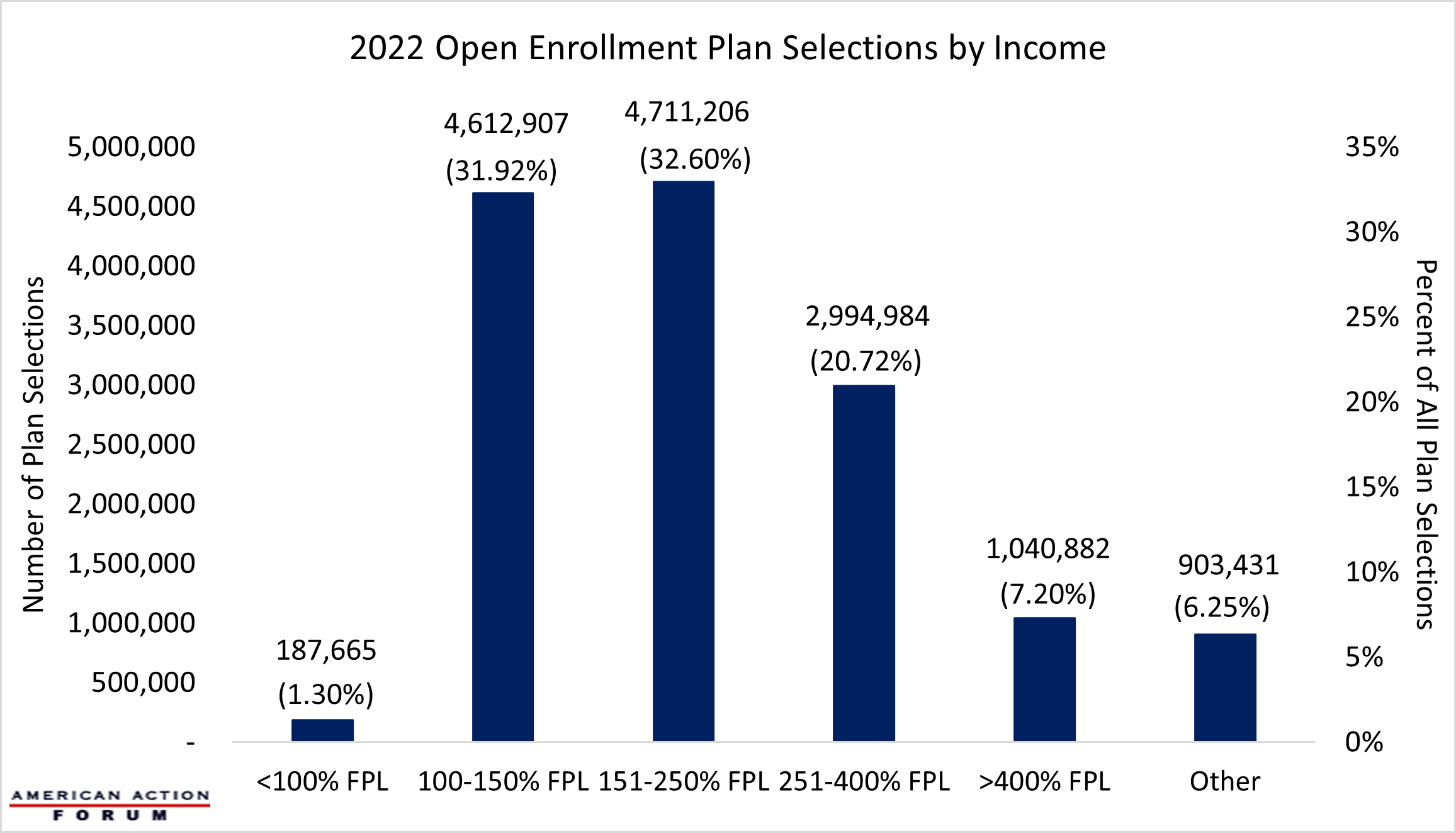

After The American Rescue Plan S Enhanced Premium Tax Credits End Aaf

8 18 20 The Supervisor S Update Town Of Bedford

Uscis Archives The National Law Forum

Sponsorship Opportunities Higher Education Leadership Forum

/https://static.texastribune.org/media/files/8f76598691a5256e24b6c7cf4a44b760/S%20unemployment%20determination%20TT%2002.jpg)

Texas Unemployment Tips And A Guide For Navigating A Confusing System The Texas Tribune

Irs Unemployment Tax Refund Summer Payment Schedule Unclear

Unemployment Tax Break Hoh 3 Dependents Taxes Were Not Withheld During Unemployment Had This Date Of June 14th Pop Up On May 28th Then It Disappeared And Went Back To As Of

Higher Education Leadership Forum

Why Some People May Get An Extra Tax Refund

Acctg 310 Lesson 10 Discussion Forum Docx Lesson 10 Discussion Forum No Unread Replies No Replies Six Of One Half Dozen Of The Other What Is The Course Hero

Oregon Dept Of Revenue Outlines Unemployment Benefit Tax Relief Steps Ktvz

This Service Helps Malware Authors Fix Flaws In Their Code Krebs On Security

After The American Rescue Plan S Enhanced Premium Tax Credits End Aaf

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time